Beating Wall Street

If you’ve been reading books on investing for any length of time you know the core tenants of Wall Street Wisdom by now:

- Diversification Myth: Diversify your Assets across Index Funds, asset classes, and geographies using low cost indices and ETFs.

- Stock Market Myth: Public stock markets are the best way to invest your money.

- Index Fund Myth: Buy low cost index funds and hold for the long-term since that’ll offer you a 10% return over the long term.

- Money Manager Myth: Don’t try to beat Wall Street money managers because they have resources and staff who spend their lives studying markets. The small investor simply can’t compete.

- Accept Average Myth: Everyone thinks they’re smarter than they are, so your best bet is to accept average returns. Don’t trick yourself into thinking you can beat index fund returns. Since 95% of asset managers can’t beat an index over 20 years, you can’t either. After all you’re not Warren Buffett.

What you probably haven’t been told is that these are all myths and half-truths. They’re only true if you accept that public stock markets are the only way to invest.

Once you buy your first house to flip, you realize you can earn 20%+ on a house flip turned into a rental. Then if you’re one of the few people to buy or operate your first successful small business, you realize you can earn 3x what Wall Street offers unleveraged.

Author’s Note: I wrote a full article on my methodology of investing that earns over 32% returns. If you’re interested check out: 32% Return – The Investing Strategy that Beats Billionaires and Beating Buffett – A Fast FI Portfolio Guide.

What’s going on here?

How is there such a big disconnect in commonly taught Wall Street wisdom and main street investing?

That’s what I seek to answer in this article as I debunk the myths of Wall Street and offer an alternative high yield perspective on investing.

Myths of Wall Street

This article is going to explain the myths of Wall Street and discuss why the small investor has an edge over money managers, and how these geniuses of Wall Street are hiding the ball when they discuss public market returns.

For the sake of this article, I’m considering Small Investors to be in the $20,000 – $10MM net worth. However, nonaccredited investors will have to create their own opportunities through hustle and learning their private market investment of choice.

Wall Street Advice

To start off, I’m going to dig into the standard money manager advice that “professionals” offer investors.

Spoiler, it’s mostly bad advice; that is if you’re above average.

Let’s summarize all those investing books that offer the novice a roadmap to investing. They start with the big enemy they’re fighting: active managers that underperform passive index funds. They build up this case through the entire book.

- Worse than Average: Most fund managers are something akin to a scam. They can’t beat a passive index over the long-term.

- High Management Fees: Fund managers underperform the market. Then for the privilege of bad performance they charge you management fees.

- Half-Truths and Misleading Language: These fund managers then do everything they can in legal jargon, playing with vocabulary (ex: average return vs actual) and half-truths to obscure their poor performance.

- Relative Returns not Absolute Returns: Furthermore, fund managers compare their returns to the relative returns of the market rather than the absolute returns that an investor earns. That means they can say they’re winning if they’re losing you less money then an index.

The fund managers aren’t the only professionals to prey on unsuspecting investors. Investment advisors and brokers are complicit as well.

Many investment advisers who invest your money for you are brokers and they don’t have fiduciary responsibility. That means they’re sales people who get kickbacks to push you into bad financial products with high fees.

However, they the author of [insert your favorite investing book] has a better way.

You can earn a higher return by simply investing in index funds and having diversification across multiple indices, asset classes, nations, … blah blah blah. Then they package a slightly better solution than the Wall Street scam that might earn 6% (think 2% after taxes and fees) rather than 4% and perhaps they’ll save you some money on taxes.

Below are three investing books that I recommend which build out the case I summarized above in more detail.

- The Little Book of Common Sense Investing – John C. Bogle

- Unshakable – by Tony Robbins

- Money Master the Game – by Tony Robbins

Don’t get me wrong.

These are great starter investing books for starters and below average investors. I also applaud them for giving people something better than Wall Street mutual funds. They’re just not good enough for an above average investor. For a smart, thoughtful person they build up a strawman case for investing in public markets, while ignoring everything outside of the public markets. This legitimizes a perspective that’s false. Namely, that small investors can’t beat their pitiful Wall Street returns.

Good sir, I strongly disagree.

I have great respect for Bogle and Robbins. I just think their investment advice is for the bottom 60%, below average. Their advice is for the person who isn’t willing (or able) to learn to invest, read a financial statement, join an investing club, or flip a house.

6% earnings is basically nothing. Subtract 3%+ inflation (expect higher inflation in the future, thank you federal reserve), and capital gains taxes. This gives you a recipe for being poor your entire life.

Also, Peter Schiff, ShadowStats.com, John Mauldin, and others make a great case that the government is understating inflation by a wide margin.

It might be as much as double the stated rate, but I digress.

Author’s Note: At the time of this writing, inflation is running at 6%, and the S&P 500 is down 19.4% last year; good bye 2+ years of 10% per year stock market wealth. On the other hand, my investments continue making me over 10x the histroic index return rate while throwing off ~50% of its returns in cash flow.

But wait. What about that 8th wonder of the world, compound interest? Won’t it save us over the long term?

Well, not really. Compound interest has to have something to work with before it becomes a powerful driver of wealth.

All of this Wall Street Advice is at best meant for the below average investor. Perhaps once you’ve achieved a high net worth, a small percentage of your portfolio MIGHT benefit from belonging in this Wall Street bucket, but it won’t make you rich.

Furthermore, this mediocre advice is exasperated by the fact that all the people writing these books made their wealth a different way. Isn’t that suspicious?

They mostly owned and scaled small businesses.

Tony Robbins created a successful self improvement empire beginning from a small business. Bogle grew Vanguard into a financial powerhouse in index fund investing beginning from a small business.

They became wealthy and then after achieving wealth, they reinvested their $50 Million + wealth empire into passive investing concepts. That’s really where compound interest makes sense. Use compound interest after you get wealthy to keep your wealth growing or at least maintain it against inflation.

We need to rebuild some of our fundamentals of investing in order to make a solution that works for the above average, ambitious investor. This article is for the person who wants to gain real wealth and not operate at below average.

Let’s dig more into the Wall Street myths and why they’re bad advice to the informed investor.

Money Manager Myths

Let’s dig further into the great Myths of Wall Street and discuss the half-truths at the heart of these myths.

Public Markets & The Index Fund Myth

Wall Street Myth: Invest in public index funds because the average mutual fund and active management firm underperforms the market by the cost of its management fees. If the professionals can’t beat the market, you probably can’t either. Use a fiduciary who charges a straightforward fee instead of mutual funds. Small investors shouldn’t expect to achieve a higher return than a passive stock index.

Debunked: Private market investments can easily beat the public market returns. Passive Small business investing can triple index fund returns whereas real estate syndication earns around 50% above index funds long term average. A BRRR (Buy, Renovate, Rent, Refinance) strategy should earn 20%+ and double the return earned by a passive index fund.

Figure 1: Public Market Benchmarks

Figure 2: Common Public Market Portfolios

Figure 3: Private Market Benchmarks

Professional Fund Manager Myth

Wall Street Myth: Ray Dalio suggested when interviewed for Money Master the Game that the small investor shouldn’t try to beat the market because large, successful funds have vast amounts of money to pay analysts, create models, and develop investing resources. A small investor simply can’t get the same insight into the market. Therefore, funds have an edge over small investors.

Debunked: Large funds and money managers have to redeploy $100’s of Million to BILLIONS in capital. They can only invest in investment instruments that can earn a return on incredibly large sums of money. Smaller investments abound outside of the public markets that offer much higher rates of return, but aren’t scalable enough for money managers investing incredibly large sums of money.

Furthermore, fund managers are graded on short term quarterly earnings and often have institutional pressures that don’t allow them to make smart or long-term focused decisions to benefit the customer.

Wall Street money managers don’t have an edge over the small investor. They’re hobbling around like a man carrying a 100 lbs bag of gold and telling you to jump on their back because they can run faster than you.

Diversification Myth

Wall Street Myth: You need diversification across the entire U.S. stock market, the world’s stock markets, and different asset classes in order to minimize risk.

Debunked: You only need 8-20 uncorrelated assets to achieve the benefits of diversification. Many legendary investors like Warren Buffett make this point when discussing their own diversification strategies. You don’t need 1000’s of tiny pieces of average companies to diversify risk.

By spreading your money across such a huge swath of the economy, you water down all the best investments to achieve average. Average in today’s world is a tiny return that’s getting smaller. If you’re invested across bonds/stocks/asset classes/countries… in a diversified portfolio expect maybe 4%-6%. Then you’ll lose most of that to taxes, fees, and inflation. Expect perhaps 2%-3% on that to be your real return. That’s tiny and not worth the cost of diversification if you’re an above average investor.

To gain that 2%-3% you’re taking the opportunity risk of never achieving financial freedom. On that return, you’ll never be able to travel the world, maximize your life impact, pay-off your mortgage, or live the life of your dreams in some island paradise.

Instead you settle for average.

Do you realize what average means?

The Average Investor Myth

Wall Street Myth: Invest in index funds and shoot for the average. Investing gurus like Warren Buffett, John Bogle, and Tony Robbins all believe that small investors should invest in index funds and accept average. If the average fund manager won’t beat the market, then how can the small investor stand a chance? Furthermore, the Superiority Bias heuristic means that our minds trick us into believing that we’re above average, so you should probably assume that you’re not.

Debunked: The average investor is a low bar to get over. Why do people accept Wall Street Wisdom when they tell them to accept average in investing, but don’t accept it in any other important area of life? Do you seek to be an average father? Work an average career? Be an average person? Skill is something you can develop in investing just as in any area of life.

Here are a few statistics.

- In wealth, the average person saves 3.4% of their income.

- The average person’s GPA is 3.0 in high school.

- The average person doesn’t have a bachelor’s degree.

- The average investor earns 4% according to Seeking Alpha.

Beating the average is a low bar to get over, because the average person doesn’t put significant effort into doing better.

Therefore, that average person isn’t competent enough to achieve success. If you choose to improve yourself, learn, and follow what exceptional people do then you’ll beat the average. Sure, there are some people who are mentally, physically, or situationally handicapped, and my heart goes out to them, but my point remains true for most of the people reading this article.

Don’t settle for average. It’s a low bar. Develop skill at investing just like you’d develop skill at anything else and you’ll multiply that average investor return by 5x+ and shave 30 years off your wait for retirement.

Average Index Return Myth

Wall Street Myth: Invest over a 20+ year period in low cost index funds. Ignore short term stock market drops and stay invested. Eventually, you’ll achieve the average return of about 10%.

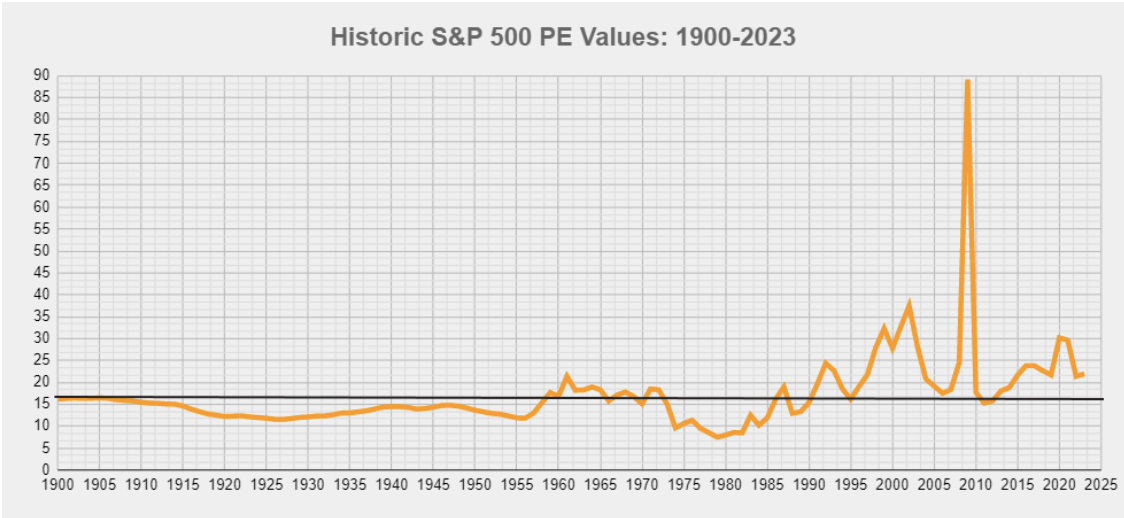

Debunked: Wall Street gurus quote index fund returns that are based on the most peaceful, prosperous and profligate period in United States (and world) history. These statistics include a 40 year debt binge by the entire country which has inflated asset prices and caused a historically high price to earnings ratio. In other words, all public, liquid assets and in the U.S. have been blown to sky high levels and achieved the everything bubble.

On top of this, in recent history we’ve had the wind at our back with globalism, no major world wars, super power status (positive trade and inflows of cash), positive demographics and a technology boom. In other words, from the end of WWII to 2008 we had the perfect moment in history for the index fund narrative of investing.

All of this led to historically high price to earnings levels in the U.S. and abroad. This perpetuated the index fund narrative, and caused huge crowds to flood into that type of investing. Wherever crowds invest, yields fall. Future returns of index investing will likely be a lot lower (maybe <6%), and have a significant risk of the everything bubble popping.

Diversified portfolios, taxes, and fees water down that return even more. To deal with this deleveraging, the federal government is incentivized to underreport inflation while printing money like a movie set drug lord. On top of all that, private market investments routinely get 15%+ if you know where to invest.

In 2008, everything changed. That was the date we started printing money to stimulate the government at the same moment when baby boomers began retiring. Demographics switched and started heading in the wrong direction, while money inflows flowed out into foreign markets.

This was also the moment when our total non-government debt peaked and began to decline. That means the deleveraging cycle began and the everything bubble almost popped. Our federal reserve stopped the catastrophe from hitting all at once, but they can’t stop the demographic trend, and the deleveraging trend as air gradually comes out of the everything bubble.

Ahead we have a period of deleveraging and printing money to decrease the weight of our debt burden fundamentally due to demographics and the end of the long debt cycle as Ray Dalio best describes it. All of this will lead to falling real prices in U.S. stock markets.

This requires a longer article to fully discuss the rise and coming fall of the Index Fund narrative, but suffice it to say, the index myth is dead. It just hasn’t been buried yet.

Figure 4: Historic S&P 500 Price to Earnings (PE) Ratios vs Average

Author’s Note: The dark gray line in the graph above shows you the historic average PE from 1900-2023 which was 16.9 PE. The above graph proves my point with PE valuation. This figure graphs the historic PE valuation with the solid gray line being the average PE throughout history. Notice how the stock market has remained above that line since about 1990 and has never recovered from the 2008 peak?

RIP Wall Street

It’s time to take these myths and throw them away so we can build a new paradigm of investing. In today’s world, there are alternative investments all around us and technology enables investing opportunities that couldn’t have been imagined a decade ago.

We’re in a golden age of knowledge, technology, and innovation even while our old, outdated investing narratives ring hollow.

The smart, small investor has a world of opportunities for high return, Fast FI, and I hope to explore them with you in future articles.

Beating Buffett: Fast FI’s Guide to High Return Investing

I briefly covered the returns I make in small business investing, and some other high return portfolio options in this article. If you’re interested in learning more, take a moment to review our Beating Buffett Portfolio Guide and read through my article 32% Return – The Investing Strategy That Beats Billionaires.

Also, I lead an investing club that offers more detailed information on how to execute on advanced financial freedom strategies. Join us or learn more by clicking here.

I’d love to connect with you online, so take a look at my LinkedIn and social links to stay in touch.

As always, seek virtue and liberty, then hustle until you get there.

“In prosperous fortunes be modest and wise; the greatest may fall and the lowest may rise.” (Benjamin Franklin)